Important Things to Consider When Retiring in Mexico

You can Retire In Paradise On A Budget

Retirement is looming large! What’s the best way to approach it? Obviously, the basics must be dealt with – finances, healthcare, and “what do I do with all that time.”

Presumably, you’ve got things you’d like to do with your new abundance of time – spend it with the grandkids, travel and see some of the places that you haven’t gotten to yet, learn a new __________ (fill in the blank: language, skill, sport, craft, culture . . .), devote more time to your hobby, share your skills and experience, or perhaps, you’d just like to “veg” for a bit before getting serious about retirement.

The foremost concern has to be your financial situation. Although, many people have had a retirement plan in place for years, in the past decade the foibles of the economy and the all-too-human plan managers have diminished, if not totally decimated, too many of those plans. Don’t let the recent economic upheaval ruin your retirement. There are options available.

If you haven’t done it yet, check out our budgeting tools, the Cost of Living Chart and the two interactive budget forms, the Estimate Budget Form and the Budget Planner Form on the Budget Forms page. But, bear in mind that the budgeting process using our forms does not include insurance protection of any kind, nor does it include any regular monthly payments (credit card, auto loan, mortgage), so you will have to factor them into your personalized budget using our “beginning” budget as a starting point.

Obviously, healthcare, car, and home (or renter’s) insurance is very important. If you’d like information specific to your situation, you can check with our friends at www.AmericanInsuranceforExpats.com, who specialize in all kinds of insurance for expats, to see what kind of coverage you can get and for how much. Maybe, you’d like a passive approach to making some additional money.

Articles on Mexico retirement

Five Reasons To Visit Mexico In The Off-Season

This time of year many so called snowbirds make their way north to spend the Summer and Fall months North of the border. These are the part time expats that have chosen to live part of the year in Mexico and the remaining time back home, essentially following the good weather, like “snowbirds.” This is […]

Listen To A Podcast On Mexico Featuring Ron Burdine

Click This link to listen to the interview now! Also, you can click here to download from iTunes to your device! Get the story from the man himself! Our founder, Ron Burdine was recently featured on the podcast “Choose to Retire in Mexico” with George Puckett. Choose to Retire in Mexico is a podcast that […]

Preparing a Mexican Will

In Mexico, there is no legal requirement to have a will which is why many Americans and Canadians waffle over creating one. However, just like it is north of the border, the main reason you should create a will is to protect a surviving spouse or heir. Mexican laws governing transfer of property is different […]

What To Do When a Loved One Passes Away in Mexico

If you are a U.S. or Canadian citizen living in Mexico, you should educate yourself and your family of the steps involved when you or your loved one passes away in Mexico. The main parties involved will be your local hospital, the funeral home and your nearest U.S. or Canadian Consulate. The first step is to choose […]

Investing in Single Premium Investment Annuities

An annuity serves as guaranteed income for those who want to supplement their retirement fund while living abroad. The advantage to an annuity is it’s guaranteed monthly income. The disadvantage is that you will not have access to your investment in the form of “one lump sum” without penalties. However, if the idea of having a guaranteed […]

Annuities To Fund Your Retirement

An annuity is a life insurance product that pays out income after age 59.5. The major draw of fixed annuities these days are the guaranteed interest rates and guarantee of income for life and/or, period certain. The size of your payments are determined by a variety of factors, including how much you invest and the […]

Filing U.S. Taxes as an Expatriate

We do not give out specific tax advice but we do recommend using a tax accountant familiar with international tax laws. As a U.S. expatriate, you are responsible for filing your U.S. taxes even if you have a $0.00 filing. This holds true if you are a retired expatriate as well. As long as your […]

Mexico on My Mind Has Released Their New 2014 Mexico Relocation Guide

FOR IMMEDIATE RELEASE October 1, 2013 Mexico on My Mind (MoMM), the Expatriate resource website for moving to and living in Mexico has just published the “Mexico Relocation Guide 2013-14”. The popular guide 2012-13 edition was downloaded over 3000 times during the last year by people looking for relocation information on Mexico and expats living […]

Banking in Mexico

The main banks in Mexico are Scotiabank, HSBC, BBVA Bancomer, Santander and Citigroup. In general, there are three main types of accounts you can open: Peso Checking Account: Allows you to manage your money in Mexican pesos and earn an interest income. The minimum balance to open a peso account ranges from $500 to $1000 pesos […]

Who Is Considered an Expatriate?

Who Is Considered An Expat? Calling yourself an expat does not necessarily mean you renounce or reject your home country. An expatriate is any person living in a different country from where they were born as a citizen. Recently, the term “expat” is often used in the context of professionals working abroad such […]

Medicare and International Travel

When Medicare was originally drafted, international travel was not as prevalent as it is today, and was not drafted into the plan. Today, many more seniors travel internationally, and limited coverage has been drafted into the Medigap policies of C,D,E,F,G,H,I and J. Medicare supplement plans include a specific benefit for Emergency Foreign Travel. However, […]

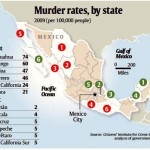

How Dangerous is Living in Mexico?

If you listen to all the news headlines about Mexico’s drug war you might believe the whole country is a drug war zone; then again you probably wouldn’t be reading this, so congratulations on over coming the negative press and doing your own research on Mexico safety! You are smarter than the average person and […]

Buying Real Estate in Mexico

Before you decide you want to buy property in Mexico, we strongly suggest you try renting in your destination of choice and you may want to try a few different areas before you decide where to settle down. Renting a place first is always a good idea. What you are expecting and the reality of life […]